But none of them, in various years, seem to have paid federal income taxes.

Or how about this one: The rich get richer … because they don’t always pay their fair share into the community chest.

Its first report (it promises more to come) is on the richest of the rich, who in certain years claim losses that can wipe out their income tax bills.

But that doesn’t mean it shouldn’t be a scandal that Mr Bezos, the richest person on Earth – who has used his vast wealth to start a spaceship company that will take him into space, where he will also be the richest person – has in multiple recent years told the federal government he owed no income taxes, according to ProPublica.

ProPublica also reports that Mr Musk, the second wealthiest human on Earth, whose wealth has grown many billions in recent years and who also has a passion project space company, told the government he owed no income tax in 2018.

The scandal is that these actions are perfectly legal.

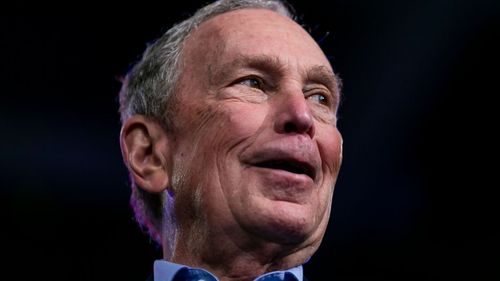

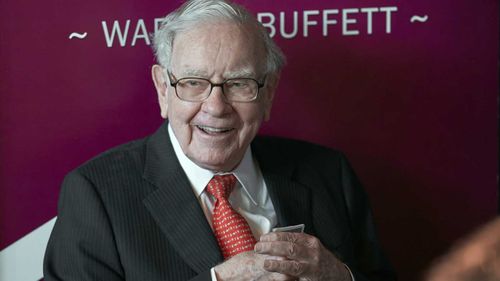

Mr Bloomberg and Mr Buffett, who have both supported raising tax rates for the wealthy, have both had $0 income tax bills. (Mr Buffett, at least, has long acknowledged this, infamously saying he paid a lower tax rate than his secretary.)

Mr Bloomberg, during his run for the 2020 Democratic presidential nomination, tangled with Senator Elizabeth Warren of Massachusetts over whether the government should tax extreme wealth in addition to income.

The report analyses how this is possible, and the reasons are many.

First, US tax law is focused on income and much of the superwealth is tied up in company stock or other investments that have real value but aren’t taxable year to year.

ProPublica cites guesstimates from Forbes, but it’s an imperfect assessment.

It lists Mr Bezos as gaining US$99 billion in wealth between 2014 and 2018.

But his income was much lower – he reported US$4.22 billion and paid US$973 million in income tax in those years.

So he paid more than 20 per cent on his reported income.

The issue is that his wealth skyrocketed at the same time.

This is something that plays out on a smaller scale for your average American homeowner or 401(k) holder, whose wealth grows without being taxed by the federal government every year.

The difference is in scale.

Also, everyday Americans likely pay property taxes and utilised mortgages to buy their homes.

The report does show how the wealthy finance their lifestyles with loans taken against assets, like real estate or stocks, rather than realising the value of an asset.

They’ll pay less to the bank in interest than they would to the government in income tax.

Carl Icahn, the investor, gave an interview to ProPublica about his tax returns and it printed this illuminating response:

“There’s a reason it’s called income tax,” he said.

“The reason is if, if you’re a poor person, a rich person, if you are Apple — if you have no income, you don’t pay taxes.”

He added: “Do you think a rich person should pay taxes no matter what? I don’t think it’s germane. How can you ask me that question?”

But in these cases, the loans do act as the income.

It’s also true that with so much of their wealth tied up in stock, they effectively pay tax through their companies; however, the corporate tax rate of 21 per cent is far lower than the top rate of 37 per cent on income over US$523,000 for individuals.

Notably, Mr Bezos has endorsed raising the corporate rate (Mr Trump and Republicans slashed it back in 2017), but as CNN has reported, it’s still unlikely his Amazon would pay anything close to either rate.

Even on the income the superwealthy do claim, often in the form of capital gains, they often pay a lower rate than Americans who make far less money.

Taxes are very much in the policy conversation at the moment

Globally, and separate from this individual income tax conversation, Mr Biden and his treasury secretary, Janet Yellen, are pushing for a global corporate minimum tax and other industrialised nations in the G-7 agreed to an outline this week.

The idea is that if everyone had at least a 15 per cent corporate tax rate, it would keep companies from avoiding taxes.

All of this feeds into the growing frustration with extreme inequality and what governments should do to make sure everyone pays their fair share, which is increasingly complicated when so much wealth is locked away from the tax man and more and more people think the government should be doing more to improve people’s everyday lives.

‘Why did they print this? Is it illegal?’

Less interesting to the larger world but really interesting to journalists like me was ProPublica’s separate story about how it got the tax documents and why it decided to selectively print them.

It is technically against the law to publish an individual’s tax information, although ProPublica argues the public interest in an informed tax debate justifies the risk.

A spokesperson for at least one of the people whose taxes it dissects – that’s Mr Bloomberg – is quoted as promising some kind of legal action, although against whoever or whatever leaked the documents, rather than ProPublica.

ProPublica doesn’t seem to know who the source of the documents is and even suggests it could have been a foreign actor, like China or Russia, that has shown an interest in stoking class resentment in the US.

That means the reporting needs to be considered against the backdrop of the mystery of its provenance.

It’s notable that none of the billionaires mentioned in the story deny the accuracy of the tax returns and some argue they were simply following the rules.

Others did not respond, according to ProPublica.

When asked about the ProPublica report on Tuesday, White House press secretary Jen Psaki told reporters, “Any unauthorised disclosure of confidential government information by a person of access is illegal and we take this very seriously.”

She said the IRS commissioner has referred the matter to investigators.

Given the status these men have in society, the deference their wealth affords them and the fact many of them have publicised their opinions on tax policy – either endorsing or opposing higher income taxes, corporate taxes and wealth taxes, I respect ProPublica’s decision.

– Analysis by Zachary B. Wolf, CNN